Finance with ambition

We back long term ambition, this at the heart of the UAE economy and the heart of our financing solutions for companies to invest in productive assets such as infrastructure, technology and other large, costly assets necessary for growth, innovation, and competitiveness.

Long-term financing in simple terms

CAPEX financing is used to purchase long-term assets or capital expenditures, such as the machinery, equipment, property or technology necessary for a company's operations or growth strategy.

It's typically used by companies without the cash flow to pay for such assets outright, or those not wanting to deplete existing cash reserves, CAPEX financing shores up the nation’s biggest corporate investments.

Investing in success

Companies can use this long-term financing option to invest in assets that will increase their productivity, efficiency and competitiveness, and ultimately contribute to their long-term success.

The repayment terms of CAPEX financing are usually longer than short-term working capital financing,

and can range up to 12 years.

Max LTV: 80%

Max Tenor: 12 years

Max grace period: 1.5 years

As the key financial engine of the UAE's economic diversification and industrial transformation agenda, we have the mandate, the power and the resources to support major CAPEX expenditure with favourable long-term repayment plans, unlike any other UAE bank.

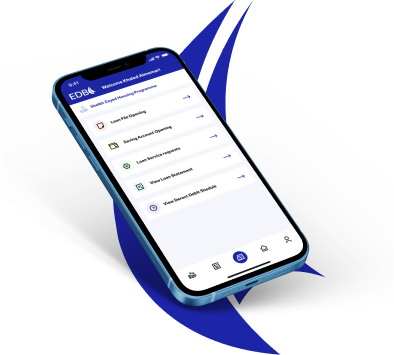

Our CAPEX loan application is as straightforward and fast as you’d expect from EDB. Simply complete the application form here, and we’ll get back to you.

What are the eligibility criteria for obtaining financing?

The eligibility criteria vary depending on the nature of the project or business. Generally, factors such as creditworthiness, business viability, and alignment with EDB's strategic objectives and focus areas are considered.

How can I apply for financing?

To apply for financing you can either call us or sign in on the website and complete an initial application form. You will be required to upload relevant documentation.

Empowering your business when you need it most

From account set up to financing business needs

Get in touch now